WHAT WE LOVE

We love to see investors be it Angel groups, VCs, FOs, CVCs and PEs, to thrive with profitable returns from their bets. We enable these investors to support upcoming firms at critical stages of their journey to bring cutting edge solutions to the world. We help investors with pipeline of promising start-ups and exit opportunities whilst supporting them in the journey as the founders commercialise, grow and scale their business. Resounding support of investors is critical especially in deeptech space, where it may take years from conceiving of idea to successful commercialisation and growth. We have deep experience in commercialising deeptech innovations and are increasingly focussed in enabling collaboration in this area.

WHAT WE DO

On behalf of investors, we take on mandates to help identify and qualify real gems, seperating the wheat from the chaff to back and invest. From late stage start-ups, early stage founders to experienced professionals, who could be great as first time founders. Once identified, we can also stay the course in the journey, to help commercialise, grow and scale these firms through a number of start-up scaling services.Our range of start-up support services can also be availed by investors with economies of scale, for their invested companies. We are also well placed to identify the apt LP's and GPs - especially CXOs and institutes for funds, besides M&A and exit opportunities.

WHY US

Having built start-ups and raised investments, we are able to bridge the gap in expectations, help prepare start-up founders and investors in arriving at faster investment outcomes. Our team has worked across multiple sectors and geographies to help build a deal flow of prospective start-ups at various stages to invest in and also help identify early experienced professionals, who could be great first time founders. Likewise, owing to our transformation and service work with CEOs and other CXOs, we understand their individual aspirations and interests to back specific innovative areas - this helps us identify potentially the right LP's and GPs for the funds being raised. Further, with our collaboration for various initiatives with corporates and larger start-ups, we are able to identify prospective M&A and exit candidates early so as to then shape a successful investment strategy for the investors. Our mentoring and scaling work for start-ups means from an investor perspective, we will be often associated with start-ups in their journey in a multi-year arrangement to be close to ground in helping them scale. Thus providing an added assurance and being in the know of the developments, for their investments into these start-ups.

Focus Verticals :

- For VCs

- For FOs

- For CVCs

- For PEs

- Deeptech

- Fintech

- Regtech

- Insuretech

- MedTech

- CleanTech

- Cyber

- Enterprise IT

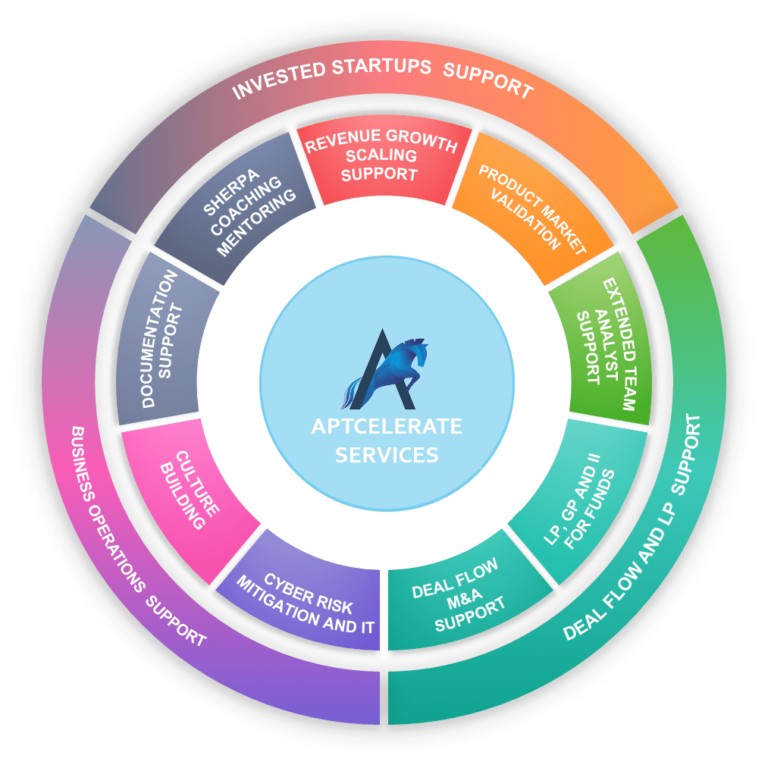

OUR RANGE OF SERVICES

DEAL FLOW , M&A SUPPORT

We work with investors to help identify relevant deal flow for promising firms to invest in and also identify and execute mandates for M&A and exits.

LP,GP AND II FOR FUNDS SUPPORT

We work with investors to help identify relevant LPs, GPs and institutional investors for existing and upcoming funds.

EXTENDED TEAM ANALYST SUPPORT

We work with investors as extended team to provided additional bandwidth as needed, for skills in business/technology/investment analyst and market insights.

DOCUMENTATION SUPPORT

We work with you and your invested firms as extended team, to effectively manage business, technical and marketing documentation along with knowledge management.

CULTURE BUILDING

We work with you and your invested firms as added hands, to help build a thriving culture critical to attract, retain and nurture a winning team.

CYBER RISK, TECHNOLOGY DEVELOPMENT

We work with you and your invested firms, to identify and support effective prevention, protection and remediation, by bringing latest in cyber products and SOC services. We also work with you to provide technology roadmap and development services, if needed on an ongoing basis

SHERPA COACHING MENTORING

We work with founder to offer our exeprience of scaling varios sized firms, to be their friend, philospher and guide

REVENUE GROWTH SCALING SUPPORT

We work with founders to help build relevant growth engines for establishing and scaling the business and also provide full time or fractional roles as needed for biz dev and sales.

PRODUCT MARKET VALIDATION

We work with founders on all aspects needed for ascertaining product fit for the offerings, be it at early MVP stage of the firm or bringing new offerings for established firms.